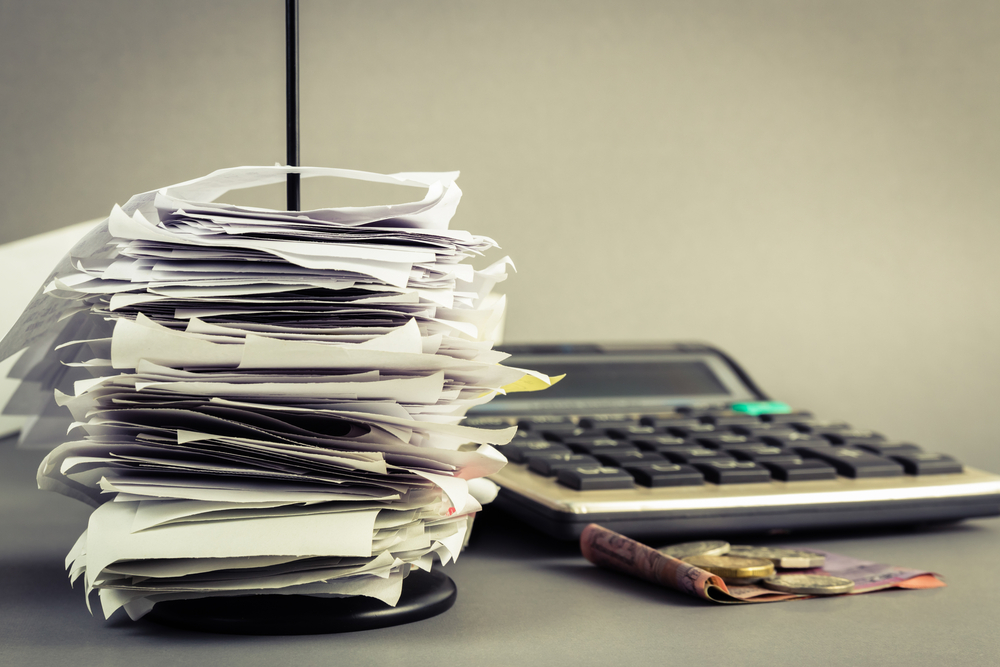

Once you’re running a business, expenses such as advertising, utilities, office supplies, and repairs can be deducted as current business expenses — but not before you open your doors for business. The costs of getting a business started are capital expenses, and you may deduct $5,000 the first year you’re in business; any remainder must be deducted in equal amounts over the next 15 years.